DEAL ALERT (CRESCENT BUYS VITAL)

Research

All Standard Disclaimers Apply & Seller Rights Retained

SPECIAL REPORT (SEPT 3, 2025)

Crescent Energy Buying Vital Energy

CREATES PERMIAN AS THIRD CORE

Pays 15% Premium To Secure Deal

$3.05B Via $750MM Equity + $2.3B Debt

138,000 BOEPD (45% Oil, 28% NGLs)

285,000 Net Acres, ~1,000 Locations

Vaults Crescent to Top 10 Pubic E&Ps

Deals Adds to Eagle Ford, Uinta Core

CRGY also shows >$40B in Permian Targets

And >$20B in Eagle Ford Growth Targets

Crescent Soon Selling $1B Non-Core Legacy

Legacy is in WY EOR, Barnett, DJ & Anadarko

Deal Expects To Close Before December 31

CLICK TO DOWNLOAD 9-PAGE REPORT

RS 2509DA

Energy Advisors Group (EAG) has issued a Deal Alert, analyzing Crescent Energy's deal to buy Vital Energy (formerly known as Laredo Petroleum) that adds Permian as a third core area in addition to the Eagle Ford and Uinta. The 9-page report is a continuation of our Market Monitor series and thought leadership efforts.

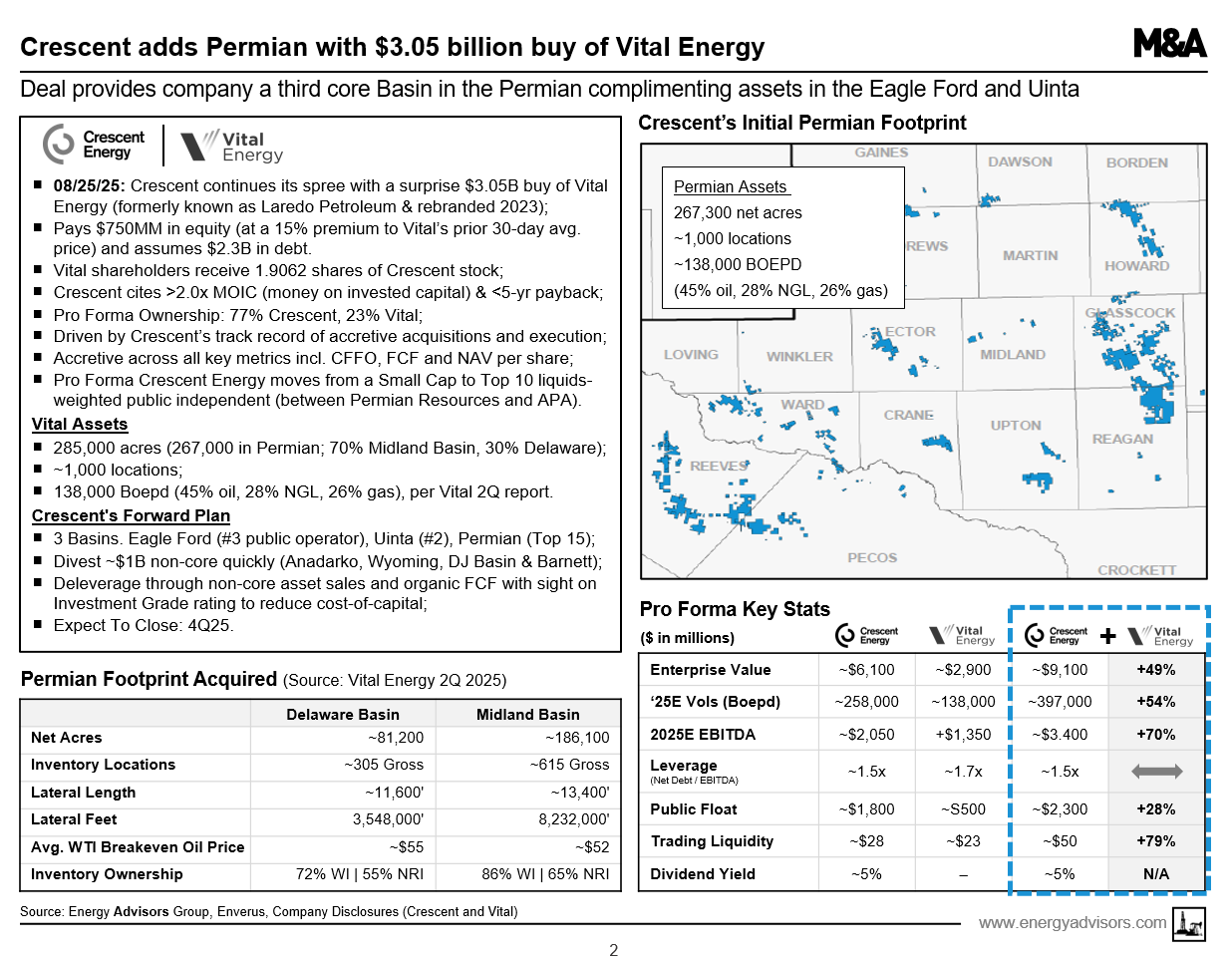

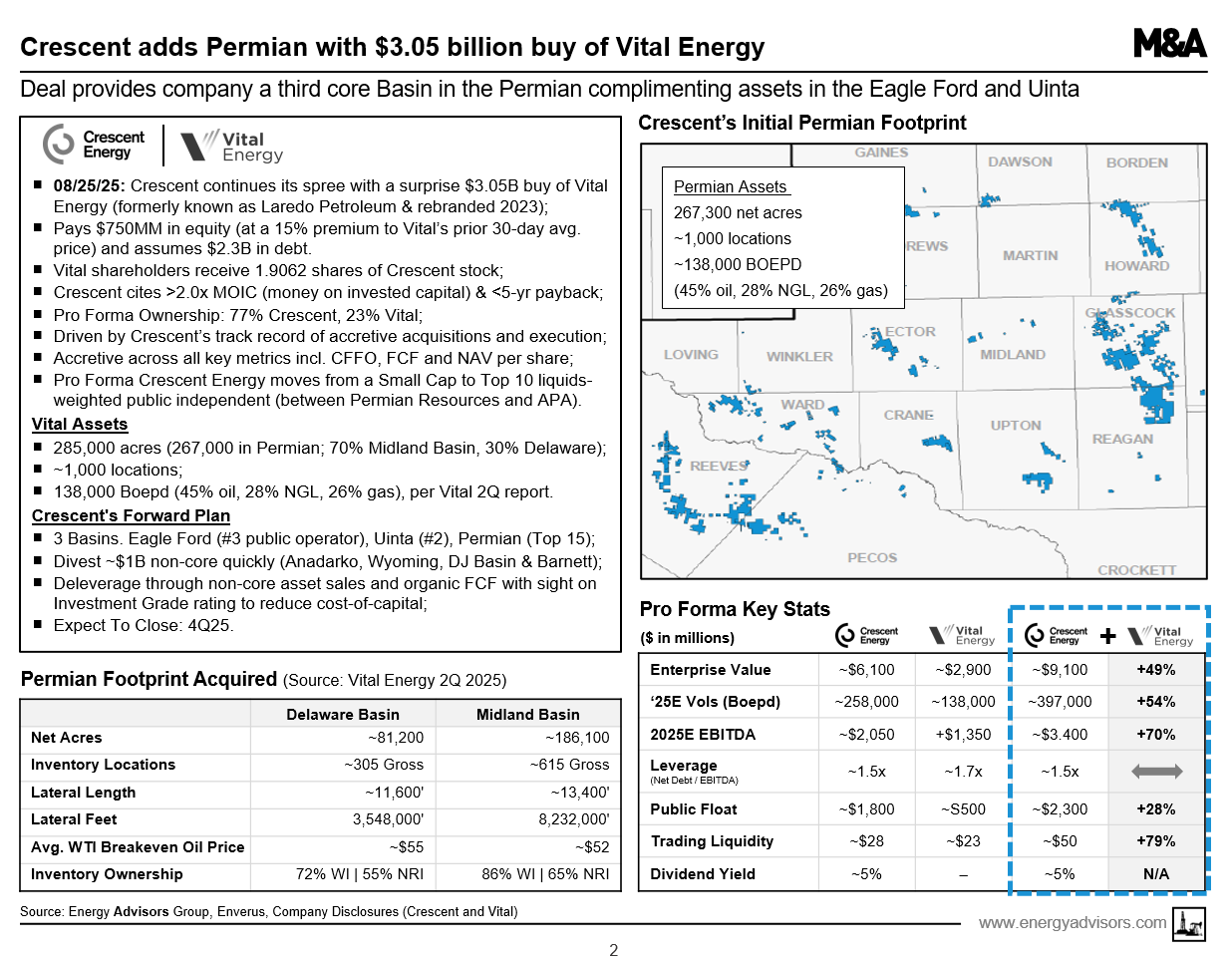

This $3.05 billion deal consists of Crescent offering 100% stock to Vital shareholders at a 15% premium and an exchange ratio of 1.9062 shares of Crescent for each share of Vital plus Crescent's assumption of $2.3 billion in Vital net debt. Pro forma ownership of Crescent will be 77% Crescent, 23% Vital. Closing is expected before December 31.

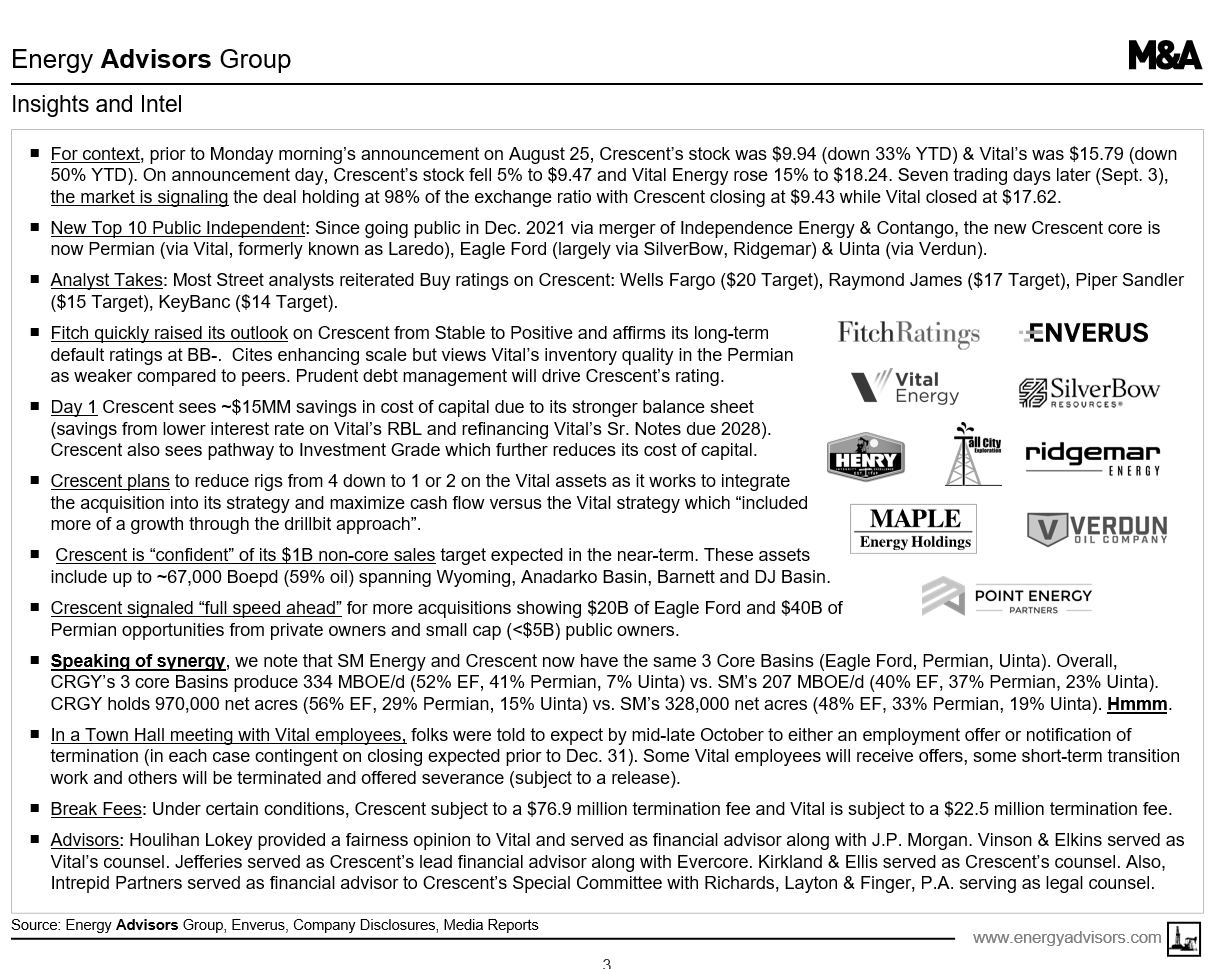

Crescent has successfully deployed a growth through acquisition strategy and is dedicated to maximizing cash flow. Consistent with that strategy, Crescent will be reducing Vital's 4-rig program in the Permian down to 1 or 2 rigs as it seeks to use cash flow to reduce debt, maintain shareholder payouts and strive for an Investment Grade rating as another tool to create value and reduce cost of capital.

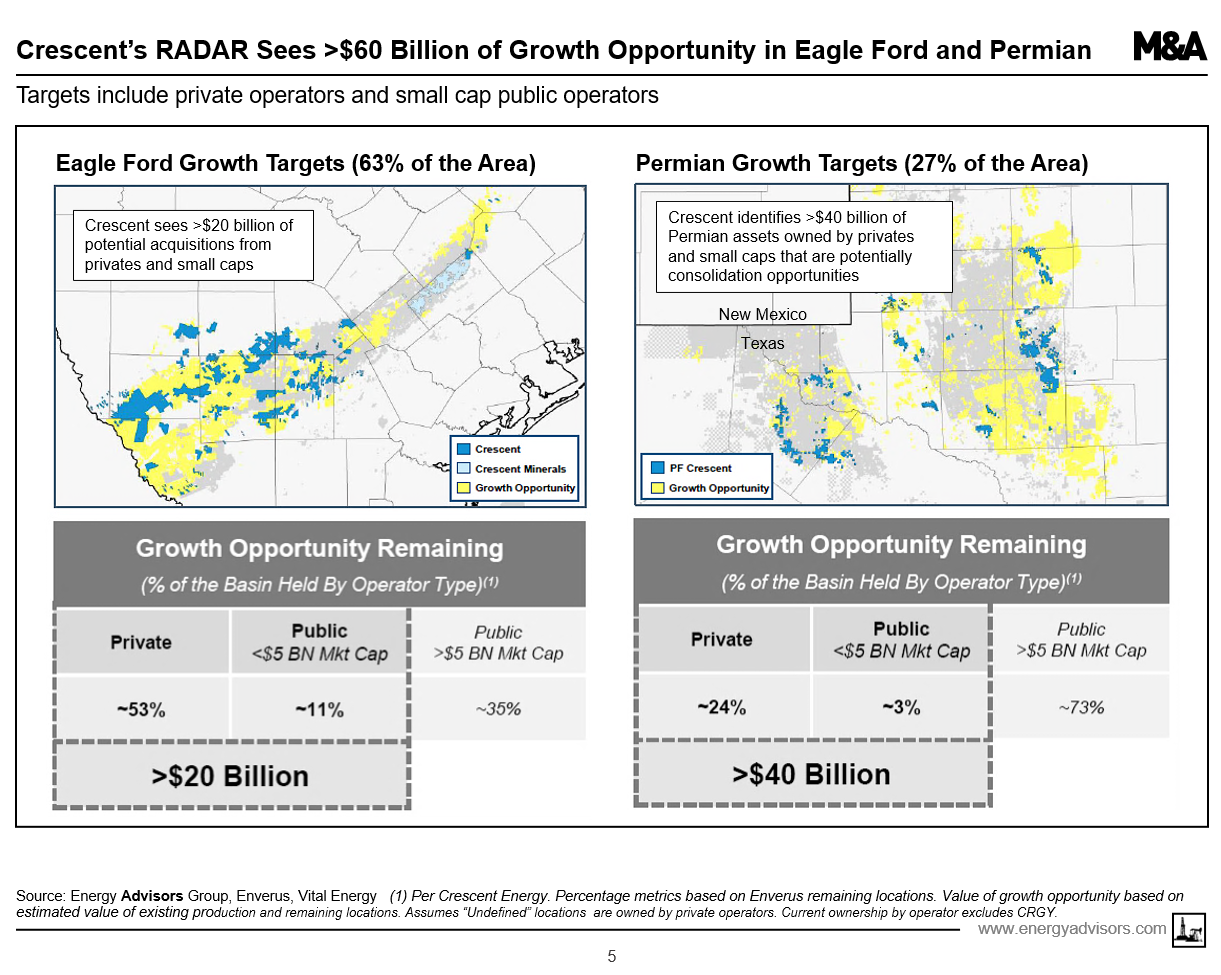

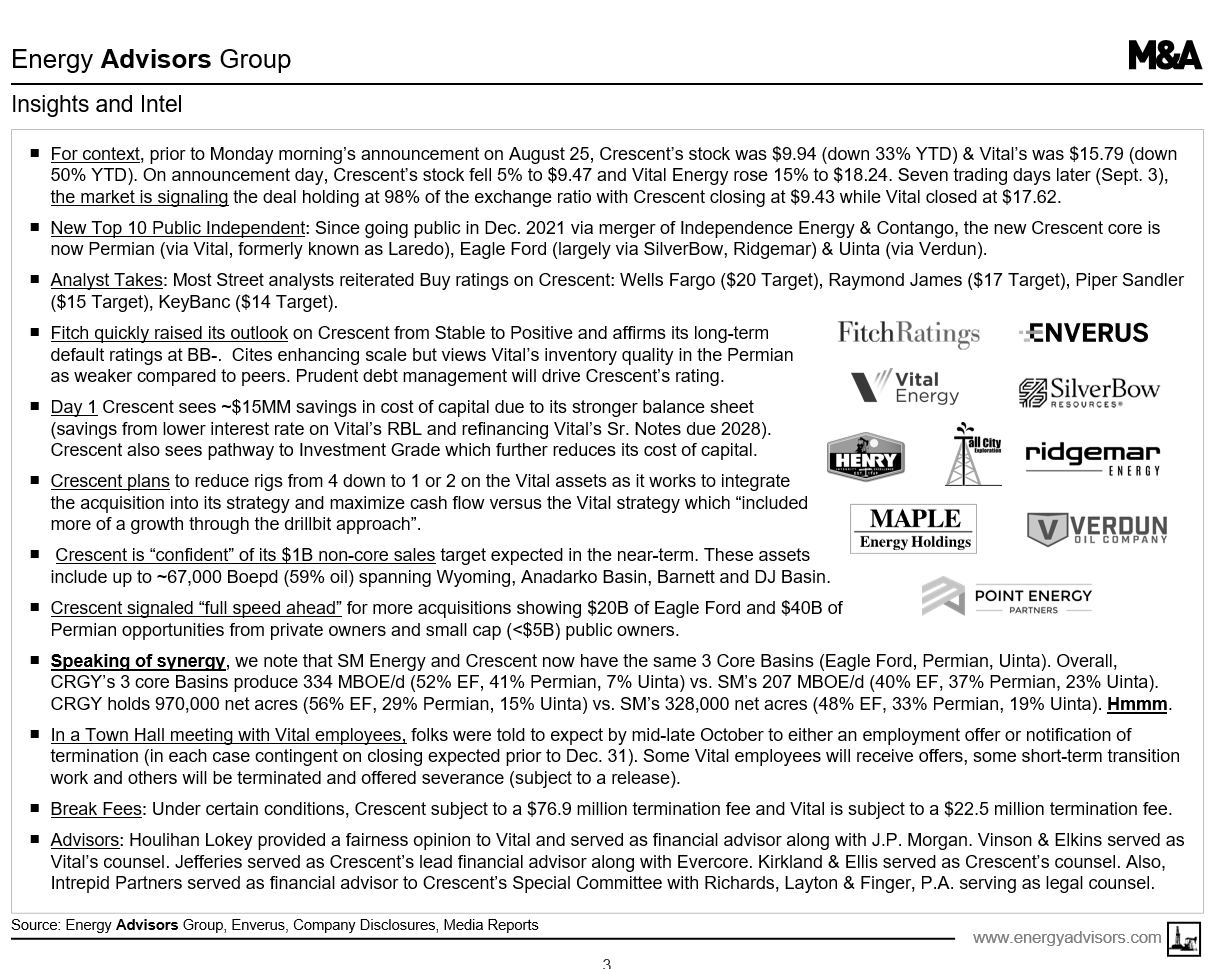

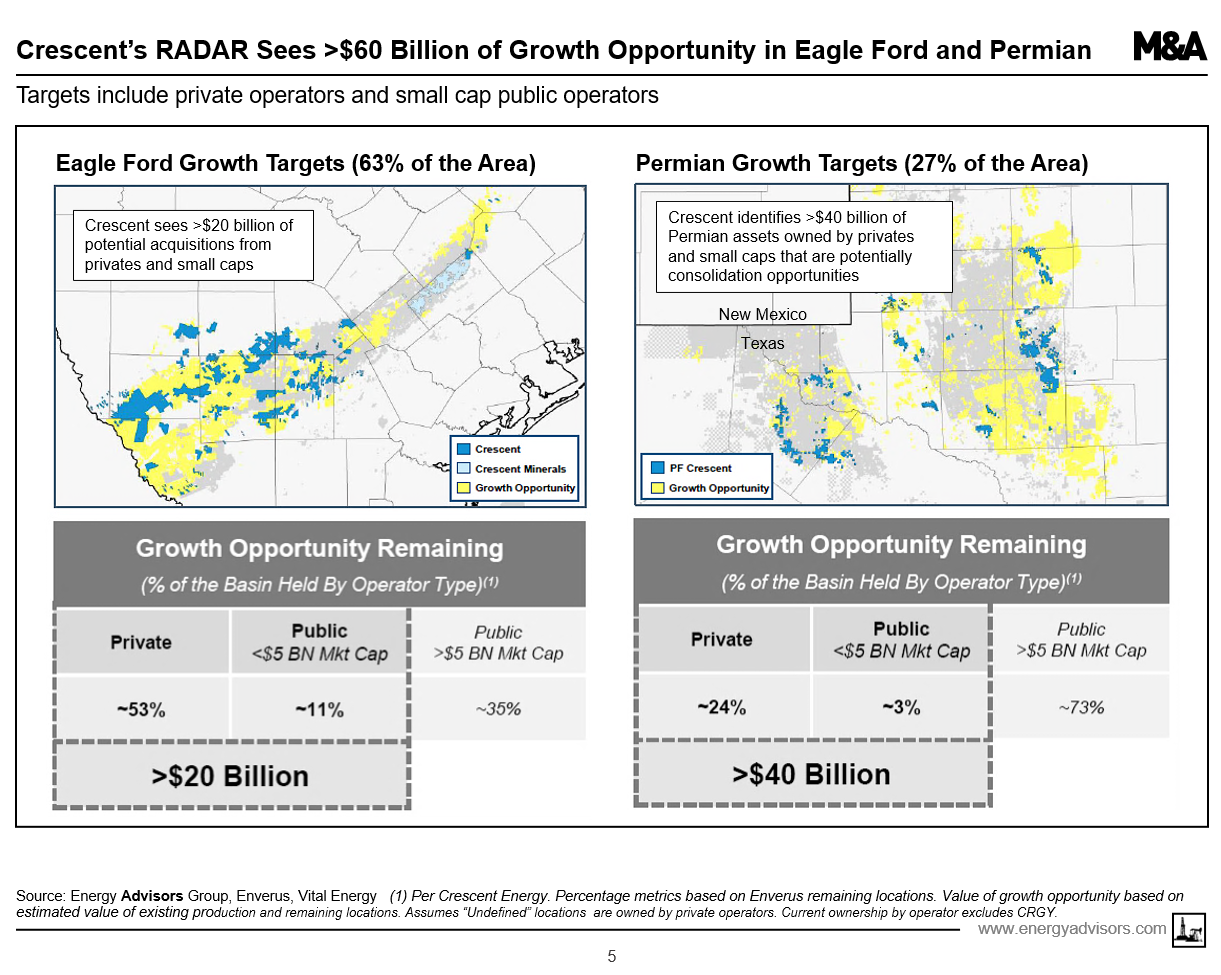

Crescent also unveiled >$60 billion of growth opportunities in the Permian and Eagle Ford. The targets are screened for private operators and small cap publics who cover ~27% of the Midland and Delaware Basins and ~64% of the Eagle Ford play.

Crescent also is confident that it will be receiving at least ~$1 billion from a non-core asset sale process underway. Initial bids for the larger assets packages were due August 16. These assets are likely to be in Wyoming EOR, DJ Basin, Barnett and Anadarko Basin where Crescent produced ~67,000 Boepd (59% oil) in 2Q 2025.

Contents and Insights:

------ Crescent Energy Adds Permian Core: Analysis of the $3.05 billion buy of Vital Energy.

------ CRGY On Track To Sell $1B Non-Core: Management "confident" it will receive at least $1 billion in non-core asset sales which we expect will be in Barnett, Wyoming, Anadarko and DJ. Bids were due August 16 on the larger packages.

------ Three Key Takeaways: Crescent says attractive valuation at 2x MOIC covered by PDP, adds Permian entry at scale and driven by Crescent's track record on acquisition execution for value creation.

------ Historical Deal Analysis: A table identifying all transactions by Crescent and Vital >$25 MM beginning with when Crescent went public in December 2021 via closing the merger of Independence Energy and Contango Oil & Gas.

------ Crescent Isn't Finished: Crescent outlines a map of >$60 billion in growth acquisition targets in the Eagle Ford and Permian, focusing on private companies and small cap publics.

Here are our quick takeaways from our report along w/ three slides.

Quick Quotes:

------- Crescent Rolls! “After going public in December 2021, Crescent has vaulted into a Top 10 liquids-weighted public independent between Permian Resources and APA.”

------- Content: “We look at Crescent's forward plans which secures the Permian, Eagle Ford and Uinta as its 3 core play platform. The company is focused on deleveraging via non-core asset sales and paying down debt through organic free cash flow and achieving value via synergies and lower cost of capital.”

------- Contrast: “While Vital was focused on growth through the drillbit and running 4 rigs in the Permian, Crescent is dropping down to a 1 or 2 rig program as it implements its strategy to maximize cash flow.”

------- Context: “Many market observers have deemed consolidation in the Permian to be largely played out, however Crescent sees more than $40 billion in Permian A&D potential via targets that mostly targets privates who hold ~24% of the Basin. Another >$20 billion in targets also seen in the Eagle Ford."

#1---

Here's an Overview

#2---

Here's our Insight & Intel on the Deal

#3---

Here's >$60 Billion of Potential Acquisition Targets in Eagle Ford & Permian

The FULL 7-page report is available for download to the right.

Energy Advisors Group is working hard to expand our thought leadership leveraging our decades of industry expertise. We look forward to providing additional market insight for our clients through Market Monitor, Regional Perspectives, Deal Alerts and Quarterly M&A Outlook.

Our firm has been serving the needs of buyers, sellers and capital providers for over thirty-five years. We stand ready to assist asset owners in a competitive divestment process and to help buyers find off-market strategic assets for their portfolio. Call Rich Martin at 214-744-2495 or email rmartin@energyadvisors.com for a private consultation.

TO LEARN MORE:

Blake Dornak

Vice President

Phone: 713-600-0169

– Email: bdornak@energyadvisors.com

Brian Lidsky

Director-Research & Special Projects

Phone: 713-600-0138

– Email: blidsky@energyadvisors.com

IF YOU NEED ASSISTANCE downloading the full report or creating a login into our platform , contact:

Stephanie Epps

– Email: stephanie@energyadvisors.com

This article is for informational purposes only and not intended as financial advice. Please conduct your own research before investing.

SPECIAL REPORT (SEPT 3, 2025)

Crescent Energy Buying Vital Energy

CREATES PERMIAN AS THIRD CORE

Pays 15% Premium To Secure Deal

$3.05B Via $750MM Equity + $2.3B Debt

138,000 BOEPD (45% Oil, 28% NGLs)

285,000 Net Acres, ~1,000 Locations

Vaults Crescent to Top 10 Pubic E&Ps

Deals Adds to Eagle Ford, Uinta Core

CRGY also shows >$40B in Permian Targets

And >$20B in Eagle Ford Growth Targets

Crescent Soon Selling $1B Non-Core Legacy

Legacy is in WY EOR, Barnett, DJ & Anadarko

Deal Expects To Close Before December 31

CLICK TO DOWNLOAD 9-PAGE REPORT

RS 2509DA

Energy Advisors Group (EAG) has issued a Deal Alert, analyzing Crescent Energy's deal to buy Vital Energy (formerly known as Laredo Petroleum) that adds Permian as a third core area in addition to the Eagle Ford and Uinta. The 9-page report is a continuation of our Market Monitor series and thought leadership efforts.

This $3.05 billion deal consists of Crescent offering 100% stock to Vital shareholders at a 15% premium and an exchange ratio of 1.9062 shares of Crescent for each share of Vital plus Crescent's assumption of $2.3 billion in Vital net debt. Pro forma ownership of Crescent will be 77% Crescent, 23% Vital. Closing is expected before December 31.

Crescent has successfully deployed a growth through acquisition strategy and is dedicated to maximizing cash flow. Consistent with that strategy, Crescent will be reducing Vital's 4-rig program in the Permian down to 1 or 2 rigs as it seeks to use cash flow to reduce debt, maintain shareholder payouts and strive for an Investment Grade rating as another tool to create value and reduce cost of capital.

Crescent also unveiled >$60 billion of growth opportunities in the Permian and Eagle Ford. The targets are screened for private operators and small cap publics who cover ~27% of the Midland and Delaware Basins and ~64% of the Eagle Ford play.

Crescent also is confident that it will be receiving at least ~$1 billion from a non-core asset sale process underway. Initial bids for the larger assets packages were due August 16. These assets are likely to be in Wyoming EOR, DJ Basin, Barnett and Anadarko Basin where Crescent produced ~67,000 Boepd (59% oil) in 2Q 2025.

Contents and Insights:

------ Crescent Energy Adds Permian Core: Analysis of the $3.05 billion buy of Vital Energy.

------ CRGY On Track To Sell $1B Non-Core: Management "confident" it will receive at least $1 billion in non-core asset sales which we expect will be in Barnett, Wyoming, Anadarko and DJ. Bids were due August 16 on the larger packages.

------ Three Key Takeaways: Crescent says attractive valuation at 2x MOIC covered by PDP, adds Permian entry at scale and driven by Crescent's track record on acquisition execution for value creation.

------ Historical Deal Analysis: A table identifying all transactions by Crescent and Vital >$25 MM beginning with when Crescent went public in December 2021 via closing the merger of Independence Energy and Contango Oil & Gas.

------ Crescent Isn't Finished: Crescent outlines a map of >$60 billion in growth acquisition targets in the Eagle Ford and Permian, focusing on private companies and small cap publics.

Here are our quick takeaways from our report along w/ three slides.

Quick Quotes:

------- Crescent Rolls! “After going public in December 2021, Crescent has vaulted into a Top 10 liquids-weighted public independent between Permian Resources and APA.”

------- Content: “We look at Crescent's forward plans which secures the Permian, Eagle Ford and Uinta as its 3 core play platform. The company is focused on deleveraging via non-core asset sales and paying down debt through organic free cash flow and achieving value via synergies and lower cost of capital.”

------- Contrast: “While Vital was focused on growth through the drillbit and running 4 rigs in the Permian, Crescent is dropping down to a 1 or 2 rig program as it implements its strategy to maximize cash flow.”

------- Context: “Many market observers have deemed consolidation in the Permian to be largely played out, however Crescent sees more than $40 billion in Permian A&D potential via targets that mostly targets privates who hold ~24% of the Basin. Another >$20 billion in targets also seen in the Eagle Ford."

#1---

Here's an Overview

#2---

Here's our Insight & Intel on the Deal

#3---

Here's >$60 Billion of Potential Acquisition Targets in Eagle Ford & Permian

The FULL 7-page report is available for download to the right.

Energy Advisors Group is working hard to expand our thought leadership leveraging our decades of industry expertise. We look forward to providing additional market insight for our clients through Market Monitor, Regional Perspectives, Deal Alerts and Quarterly M&A Outlook.

Our firm has been serving the needs of buyers, sellers and capital providers for over thirty-five years. We stand ready to assist asset owners in a competitive divestment process and to help buyers find off-market strategic assets for their portfolio. Call Rich Martin at 214-744-2495 or email rmartin@energyadvisors.com for a private consultation.

TO LEARN MORE:

Blake Dornak

Vice President

Phone: 713-600-0169

– Email: bdornak@energyadvisors.com

Brian Lidsky

Director-Research & Special Projects

Phone: 713-600-0138

– Email: blidsky@energyadvisors.com

IF YOU NEED ASSISTANCE downloading the full report or creating a login into our platform , contact:

Stephanie Epps

– Email: stephanie@energyadvisors.com

This article is for informational purposes only and not intended as financial advice. Please conduct your own research before investing.