03Q25 QUARTERLY M&A REPORT

Research/Study

All Standard Disclaimers Apply & Seller Rights Retained

DEAL PERSPECTIVES (MEDIA VERSION)

Quick 10 Pages of the Full 25 Page Report

$9.6B IN 3Q25 - DOWN FROM $13.6B IN 2Q

Deals Increase to 22, Up From 16 in 2Q

Close to the 23 Deals/Qtr Avg. Since 2022

Crescent Energy pays $3.6B for Vital

CRC buys Berry Petroleum for $717MM

Stone Ridge Buys COP's Anadarko for $1.3B

MACH Pays $1.3B for Conventional PDP

Hungry Buyer Universe

Minerals and NonOp Continue HOT

Consolidation Ongoing, More Coming

PDP and Conventional Assets Strong

4Q Looks Like Deals Accelerating

CONTACT EAG FOR FULL 25 PAGE REPORT

RS 2512MA

THIS IS THE ABBREVIATED MEDIA VERSION

Energy Advisors Group has released a 3Q 2025 Special Report on the U.S. A&D marketplace as a continuation of our Market Monitor Series and thought leadership efforts. The full 25-page Special Report provides perspectives on the outlook plus past and current trends in deal values, counts, plays and valuations.

Our firm has over 35 years of experience assisting clients navigate the marketplace to maximize their portfolios as advisors on both the sell and buy side. Energy Advisors also provides consulting services including asset management and optimization.

Here are our quick quotes, and current market themes from our report.

Quick Quotes:

------- How was the third quarter? "Publicly reported transactions rebounded in 3Q25 to 22 deals, up from 16 prior quarter. However, value lagged at $9.6B, down from $13.6B. Consolidation continues (CRC/Berry, Crescent Energy/Vital)."

------- Natural Gas Deals Increasing. "Natural gas deals should continue to pick up with more with non-traditional buyers. Hedge funds like Citadel, asset managers like Stone Ridge and international interest from Asia add competitive pressure."

------- Hungry Buyers. "Family offices, private investors, hedge funds and larger publics are all seeking assets - some driven by attractive solid cash flow and valuations in a market that lacks the investor enthusiasm around all things AI."

------- Metrics: "Current economic ratio of 13:1 with market multiples of $45,000 ppbo/d and $3,400 ppmcf/d.”

------- Globally: "Upstream, 3Q25 was $17.7 billion down from $23.6 billion. US share 55%, Canada 36% and International 9%."

Market Themes:

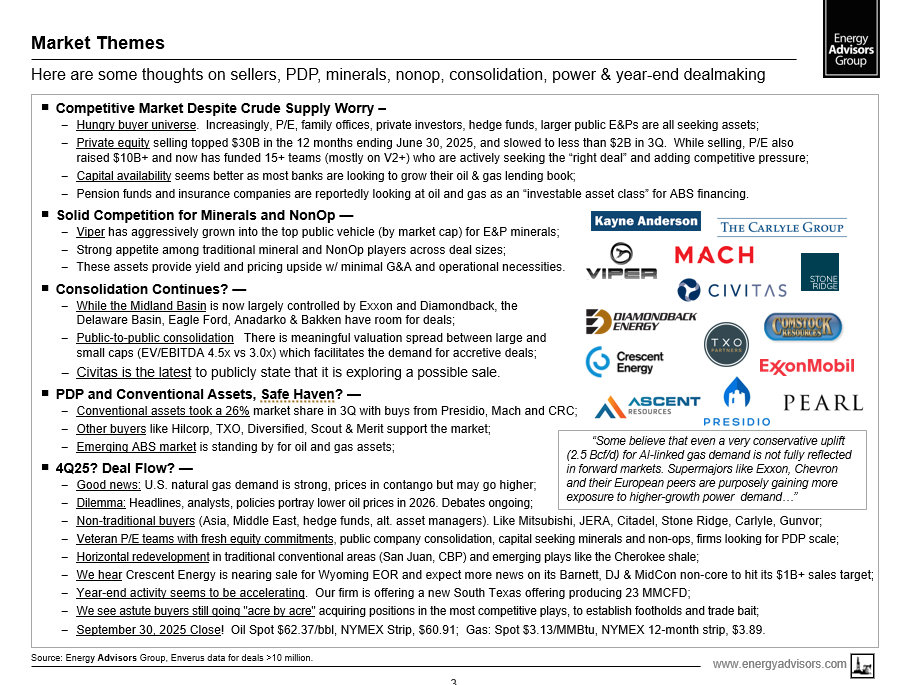

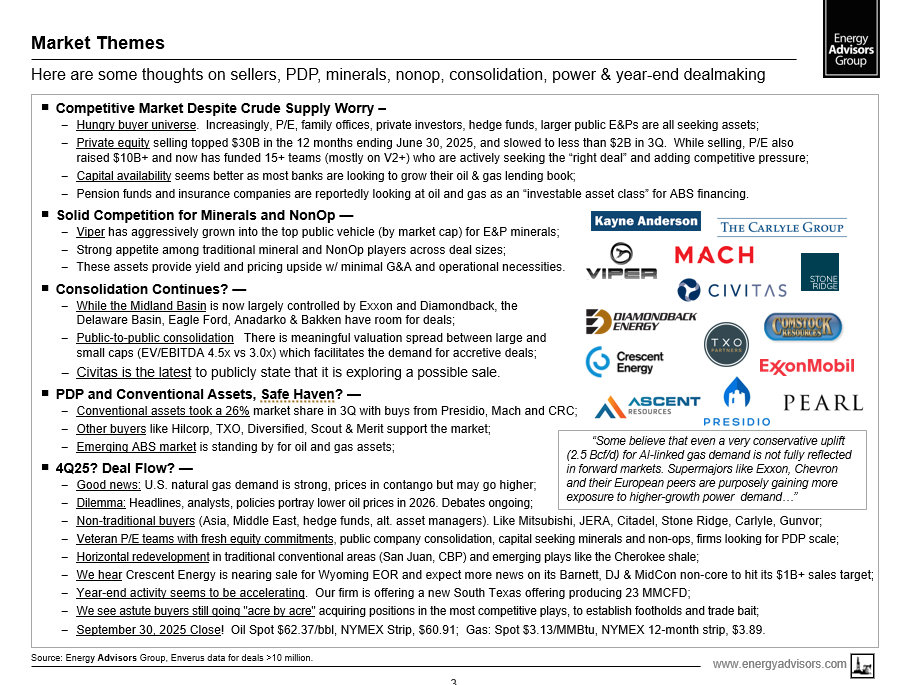

------- Competitive Market Despite Crude Price Worry. A hungry buyer universe combined with fresh capital from P/E, banks looking to grow their lending books, and increasing support from ABS financiers contribute to solid competition for quality assets.

------- Minerals and NonOp Have Solid Competition. A continuing theme across all deal sizes as investors drawn to attractive yields and pricing upside and investments needing minimal G&A and operational necessities.

------- Consolidation Plays. The valuation gap between large cap and small cap public E&Ps facilitates more consolidation. While Midland Basin is largely locked up, other areas like the Delaware, Eagle Ford, Utica, Bakken and Anadarko all have substantial running room for more deals.

------- Power. Some believe that the uplift in power needs from natural gas is not fully reflected in the forward markets. Supermajors, E&Ps and midstream companies are all purposely gaining more exposure higher-growth power demand.

------- 4Q25? Accelerating Deal Flow? We're hearing Crescent Energy nearing a sale of its Wyoming EOR and expect more news on its Barnett, DJ and MidCon non-core sales would confirm its $1B+ target. Civitas is "exploring" a strategic sale. Citadel is reportedly in talks for 150 MMcfpd legacy Haynesville from Comstock. Large privates like Aethon (Haynesville) and Ascent (Utica/Marcellus) are also reportedly open to deals or potential IPO. Media has reported the Japanese utility JERA is in talks for GEP Haynesville II (a GeoSouthern/Williams JV).

#1---

Here is additional insight from the report taken from one of our slides:

#2---

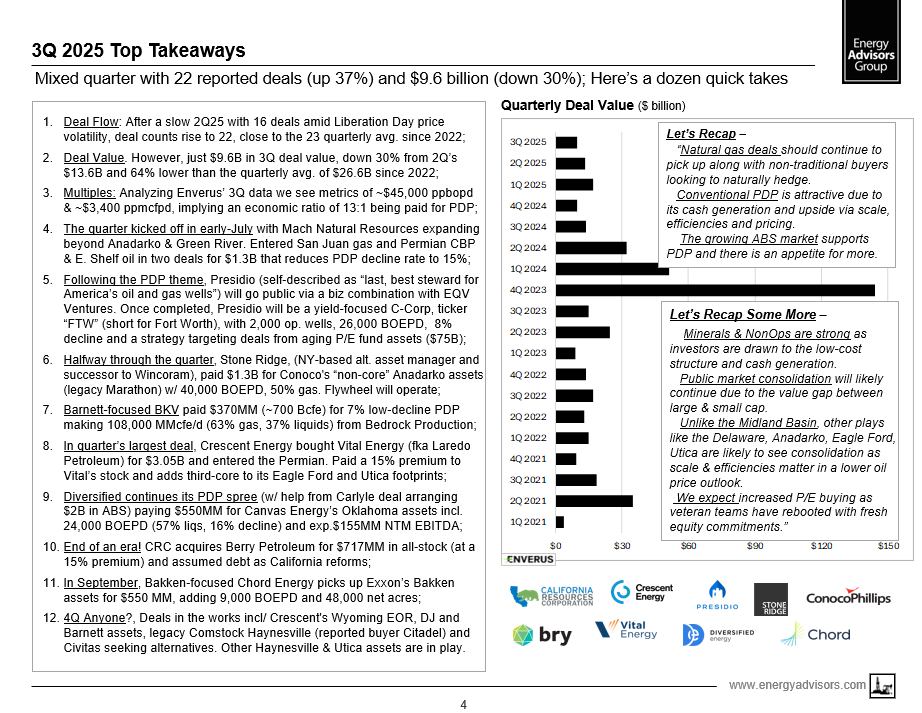

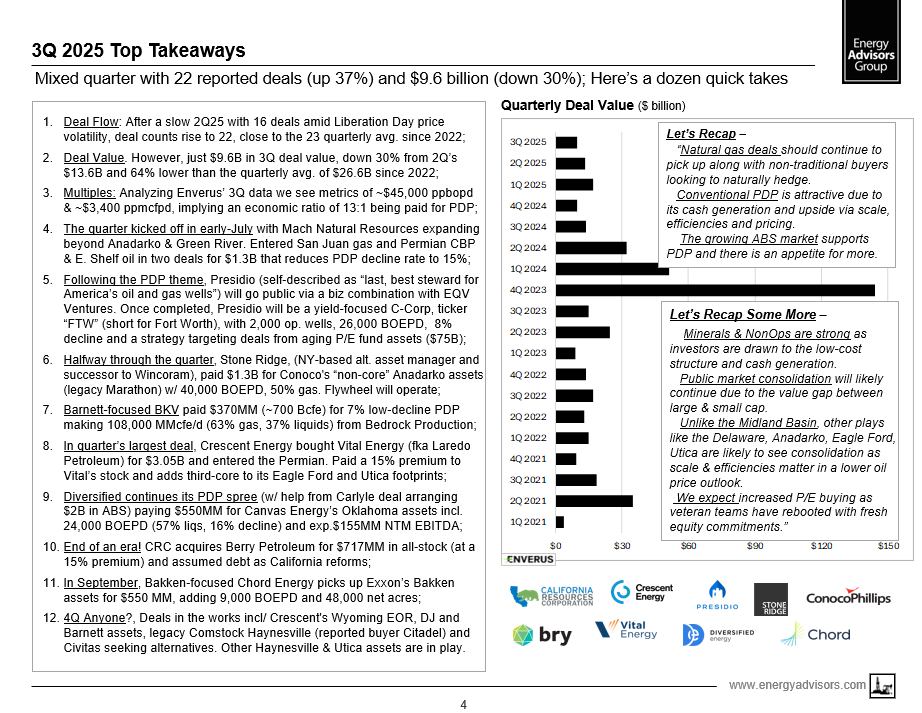

Here are a Dozen Quarterly Takeaways and Quick Outlook:

#3---

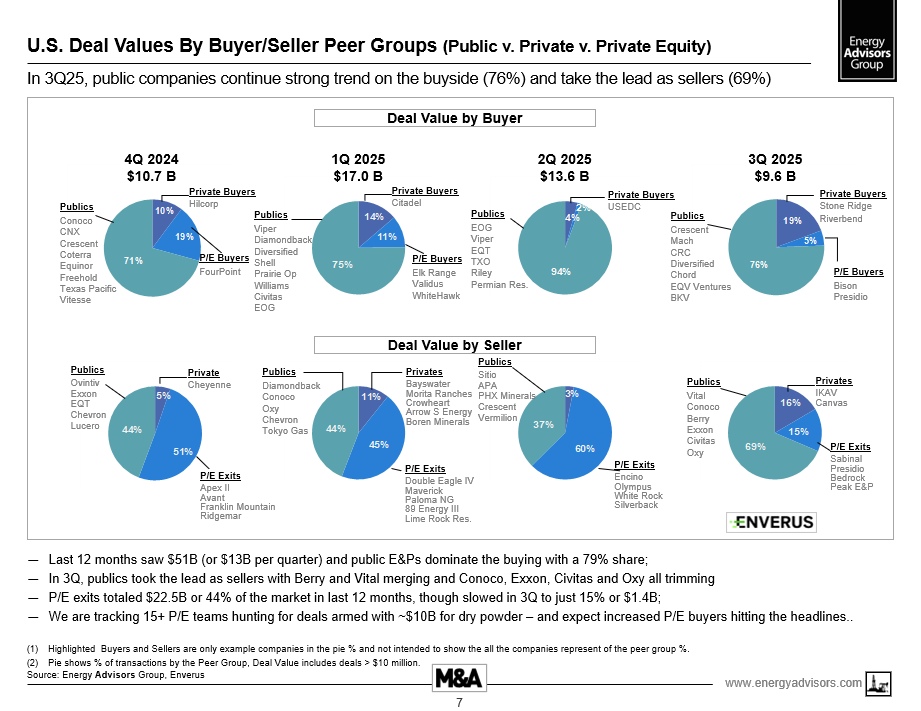

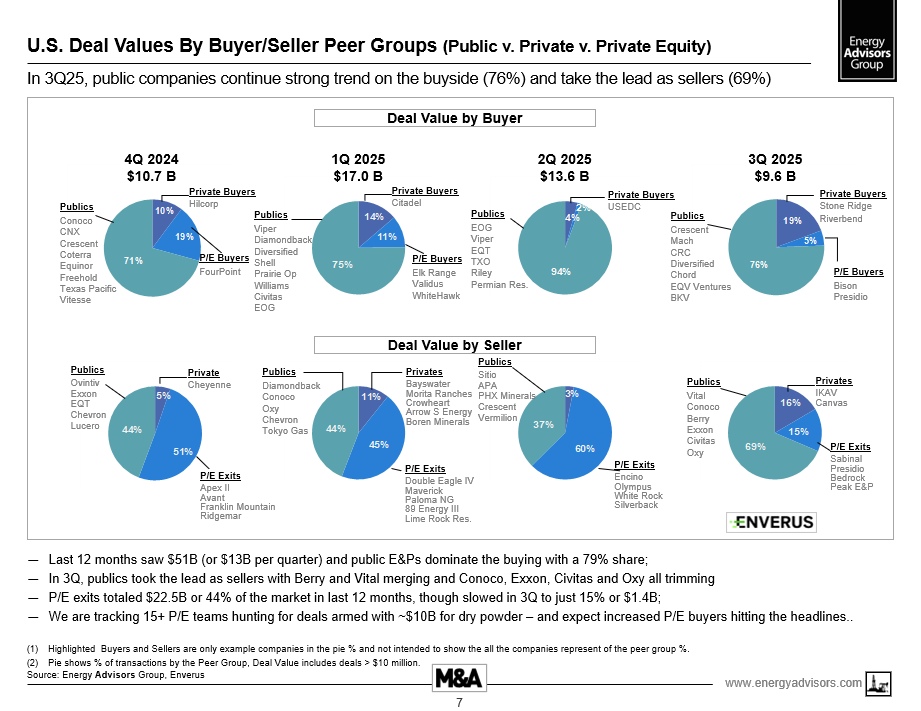

Here is a striking slide demonstrating public companies dominating the buyside:

The 10-page media report is available to the right.

Interested parties desiring to see the entire 25 page report should email any one of us down below for the complete version.

Energy Advisors Group is working hard to expand our thought leadership and look forward to providing additional market insight for our clients through regional perspectives, M&A analysis and market monitor.

Our firm has been serving the needs of buyers, sellers and capital providers for over thirty-five years.

TO LEARN MORE AND RECIEVE A COPY OF THE FULL REPORT CONTACT :

Blake Dornak

Vice President

Phone: 713-600-0169

– Email: bdornak@energyadvisors.com

Brian Lidsky

Director

Phone: 713-600-0138

– Email: blidsky@energyadvisors.com

Corporate Office:

4265 San Felipe Ste 650

Houston TX 77027

Corporate Switchboard: 713-600-0123

DEAL PERSPECTIVES (MEDIA VERSION)

Quick 10 Pages of the Full 25 Page Report

$9.6B IN 3Q25 - DOWN FROM $13.6B IN 2Q

Deals Increase to 22, Up From 16 in 2Q

Close to the 23 Deals/Qtr Avg. Since 2022

Crescent Energy pays $3.6B for Vital

CRC buys Berry Petroleum for $717MM

Stone Ridge Buys COP's Anadarko for $1.3B

MACH Pays $1.3B for Conventional PDP

Hungry Buyer Universe

Minerals and NonOp Continue HOT

Consolidation Ongoing, More Coming

PDP and Conventional Assets Strong

4Q Looks Like Deals Accelerating

CONTACT EAG FOR FULL 25 PAGE REPORT

RS 2512MA

THIS IS THE ABBREVIATED MEDIA VERSION

Energy Advisors Group has released a 3Q 2025 Special Report on the U.S. A&D marketplace as a continuation of our Market Monitor Series and thought leadership efforts. The full 25-page Special Report provides perspectives on the outlook plus past and current trends in deal values, counts, plays and valuations.

Our firm has over 35 years of experience assisting clients navigate the marketplace to maximize their portfolios as advisors on both the sell and buy side. Energy Advisors also provides consulting services including asset management and optimization.

Here are our quick quotes, and current market themes from our report.

Quick Quotes:

------- How was the third quarter? "Publicly reported transactions rebounded in 3Q25 to 22 deals, up from 16 prior quarter. However, value lagged at $9.6B, down from $13.6B. Consolidation continues (CRC/Berry, Crescent Energy/Vital)."

------- Natural Gas Deals Increasing. "Natural gas deals should continue to pick up with more with non-traditional buyers. Hedge funds like Citadel, asset managers like Stone Ridge and international interest from Asia add competitive pressure."

------- Hungry Buyers. "Family offices, private investors, hedge funds and larger publics are all seeking assets - some driven by attractive solid cash flow and valuations in a market that lacks the investor enthusiasm around all things AI."

------- Metrics: "Current economic ratio of 13:1 with market multiples of $45,000 ppbo/d and $3,400 ppmcf/d.”

------- Globally: "Upstream, 3Q25 was $17.7 billion down from $23.6 billion. US share 55%, Canada 36% and International 9%."

Market Themes:

------- Competitive Market Despite Crude Price Worry. A hungry buyer universe combined with fresh capital from P/E, banks looking to grow their lending books, and increasing support from ABS financiers contribute to solid competition for quality assets.

------- Minerals and NonOp Have Solid Competition. A continuing theme across all deal sizes as investors drawn to attractive yields and pricing upside and investments needing minimal G&A and operational necessities.

------- Consolidation Plays. The valuation gap between large cap and small cap public E&Ps facilitates more consolidation. While Midland Basin is largely locked up, other areas like the Delaware, Eagle Ford, Utica, Bakken and Anadarko all have substantial running room for more deals.

------- Power. Some believe that the uplift in power needs from natural gas is not fully reflected in the forward markets. Supermajors, E&Ps and midstream companies are all purposely gaining more exposure higher-growth power demand.

------- 4Q25? Accelerating Deal Flow? We're hearing Crescent Energy nearing a sale of its Wyoming EOR and expect more news on its Barnett, DJ and MidCon non-core sales would confirm its $1B+ target. Civitas is "exploring" a strategic sale. Citadel is reportedly in talks for 150 MMcfpd legacy Haynesville from Comstock. Large privates like Aethon (Haynesville) and Ascent (Utica/Marcellus) are also reportedly open to deals or potential IPO. Media has reported the Japanese utility JERA is in talks for GEP Haynesville II (a GeoSouthern/Williams JV).

#1---

Here is additional insight from the report taken from one of our slides:

#2---

Here are a Dozen Quarterly Takeaways and Quick Outlook:

#3---

Here is a striking slide demonstrating public companies dominating the buyside:

The 10-page media report is available to the right.

Interested parties desiring to see the entire 25 page report should email any one of us down below for the complete version.

Energy Advisors Group is working hard to expand our thought leadership and look forward to providing additional market insight for our clients through regional perspectives, M&A analysis and market monitor.

Our firm has been serving the needs of buyers, sellers and capital providers for over thirty-five years.

TO LEARN MORE AND RECIEVE A COPY OF THE FULL REPORT CONTACT :

Blake Dornak

Vice President

Phone: 713-600-0169

– Email: bdornak@energyadvisors.com

Brian Lidsky

Director

Phone: 713-600-0138

– Email: blidsky@energyadvisors.com

Corporate Office:

4265 San Felipe Ste 650

Houston TX 77027

Corporate Switchboard: 713-600-0123